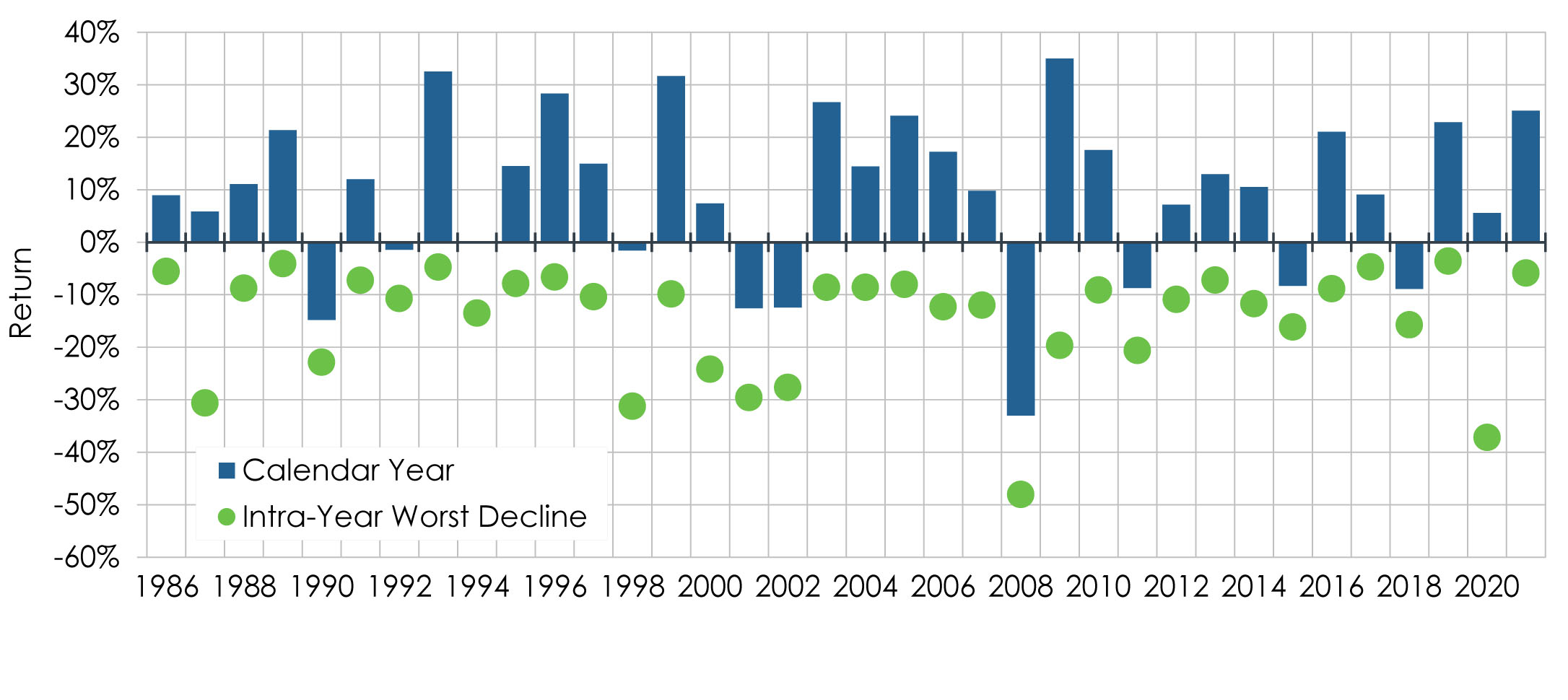

Market volatility can be unsettling; historically, however, the market has recovered from intra-year declines and provided positive returns for investors over time.

Intra-year decline is the difference between the highest and lowest point in the market during that year

S&P/TSX Composite Total Return Index annual total returns and intra-year declines: 1986-2021

Overall, the trend has been positive since 1980. The S&P/TSX Composite Total Return Index has shown a positive return in 29 out of the 36 full years shown on this chart, which is nearly 81% of the time.

Despite this positive long-term trend, it is important to highlight that over this same period, on average, the largest drop in price from peak to trough for the Index in any given year has been 15%. In other words, intra-year declines of more than 10% are quite normal.

While declines of 10% or more are normal, the average annual calendar year gain has been roughly 10% per year.