A corporation may buy life insurance so money is available when the insured person dies. Funds may be needed for:

A death benefit can help corporations avoid borrowing or withdrawing a large sum of money from business operations at a critical time – essentially, it can help business continue as usual.

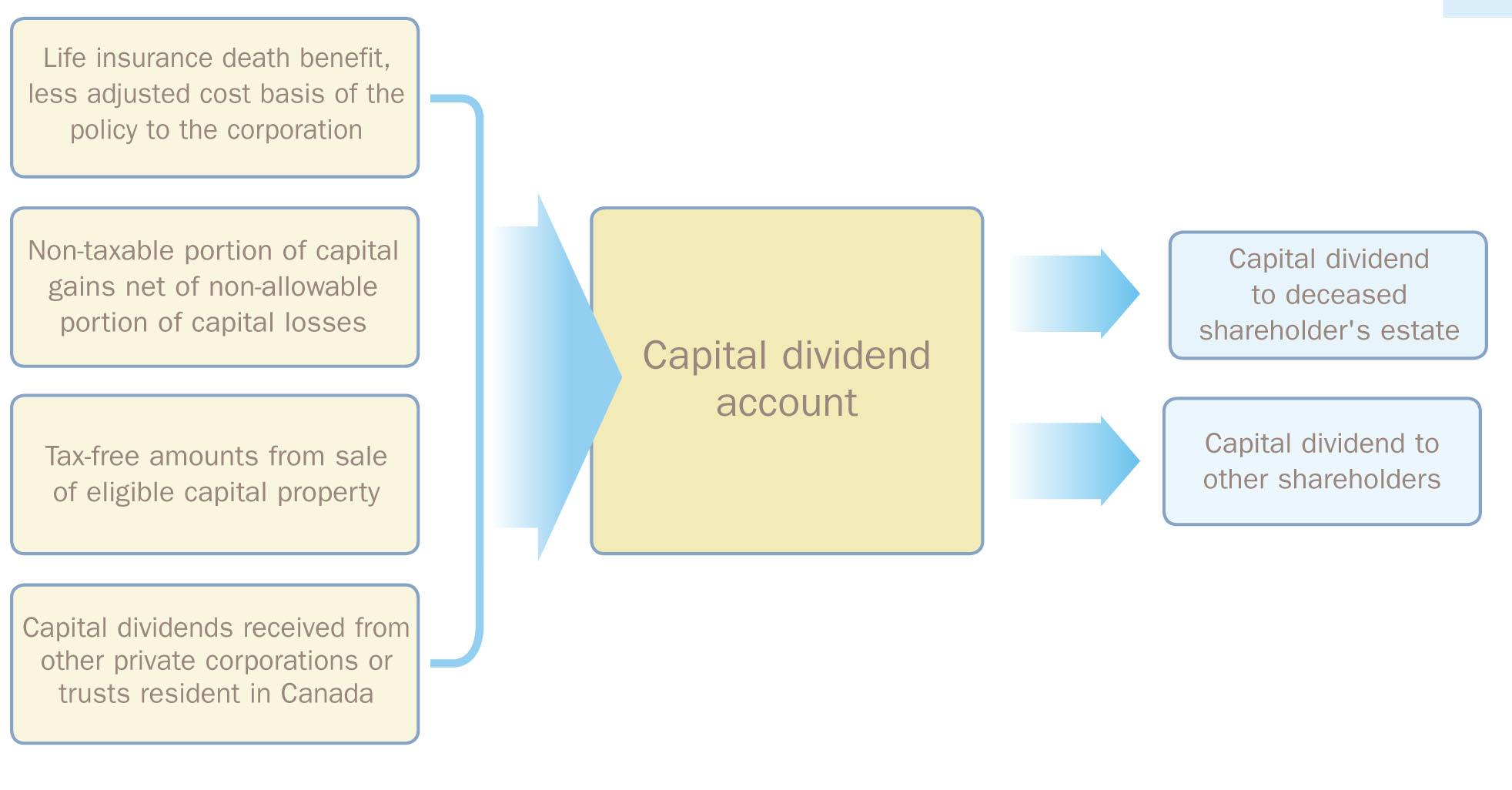

A capital dividend account is a notional account that tracks certain types of income earned by a private corporation resident in Canada. It may be distributed by the corporation as a tax-free dividend to its Canadian resident shareholders. 1

1 Tax withholding is required if any dividend (including a capital dividend) is paid to non-resident shareholders.

When the insured dies, the corporation receives the death benefit, which credits its capital dividend account by an amount equal to the death benefit less the adjusted cost basis of the insurance policy.

If the policy is used to secure the indebtedness of the corporation, the corporation receives a credit to its capital dividend account on the same basis – even when the death benefit is paid directly to the creditor.

Corporations have the flexibility to determine when they elect to pay capital dividends.

The capital dividend account balance resulting from receipt of death benefit proceeds will remain until such time as capital dividends are paid.2 Since detailed knowledge of tax legislation is required for the election process, it’s recommended that the corporation’s tax accountant be involved.

2 Corporations have the flexibility to determine when they elect to pay capital dividends. The capital dividend account balance resulting from receipt of death benefit proceeds will remain until such time as capital dividends are paid. 2 Since detailed knowledge of tax legislation is required for the election process, it’s recommended that the corporation’s tax accountant be involved. The balance available in the capital dividend account may be reduced by the capital losses realized after receiving the death benefit.

The information provided is based on current tax legislation and interpretations for Canadian residents and is accurate to the best of our knowledge as of November 2015. Future changes to tax legislation and interpretations may affect this information. This information is general in nature, and is not intended to be legal or tax advice. For specific situations, you should consult the appropriate legal, accounting or tax advisor.